Tax Responsibilities

All international students with F-1 status are responsible for filing appropriate income tax forms each year, even if they have no U.S. income.

Tax Year 2023 Filing DEADLINE: Monday, April 15, 2024.

The U.S. Internal Revenue Service (IRS) deadline for filing a tax return if you had U.S. income in 2023 is Monday, April 15 2024. Students who did not have U.S. income but were present in the U.S. in 2023 for any amount of time (January 1–December 31, 2023) still need to file a Form 8843 with the IRS. Students can use Sprintax to assist with either filing a tax return or a Form 8843.

ISS has partnered with Sprintax to assist you in meeting your tax filing obligations as an international student. Your code will be sent to your Elmhurst email address and will allow you to access the easy-to-use Sprintax Tax Filing Software designed for non-resident students and scholars in the U.S.

Am I a Resident or Non-Resident for Federal Tax Purposes?

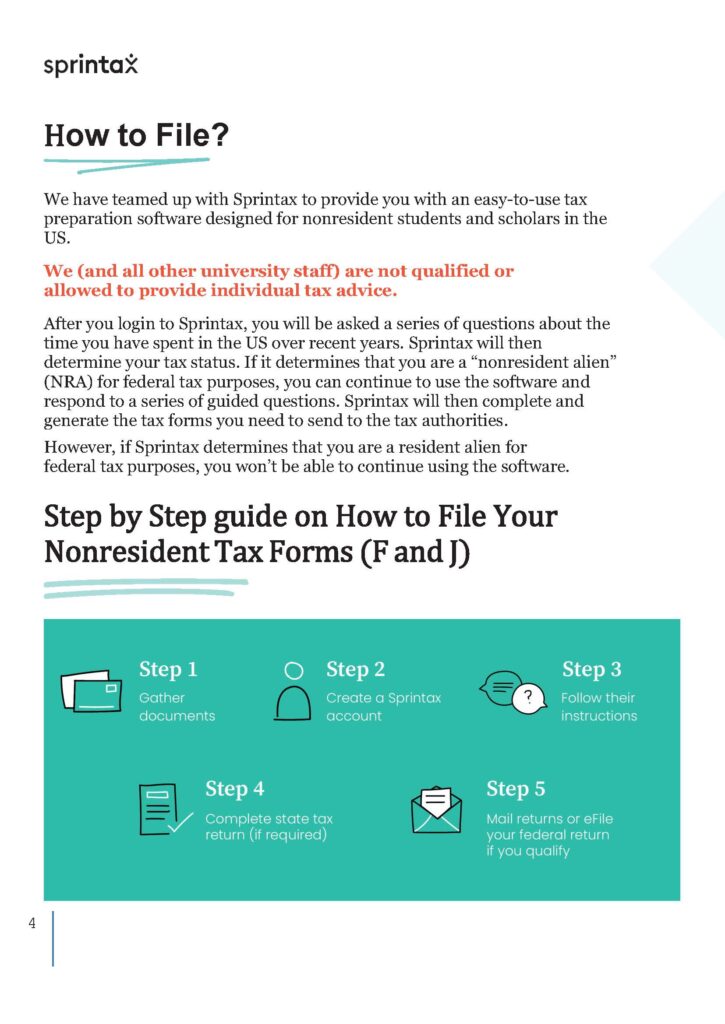

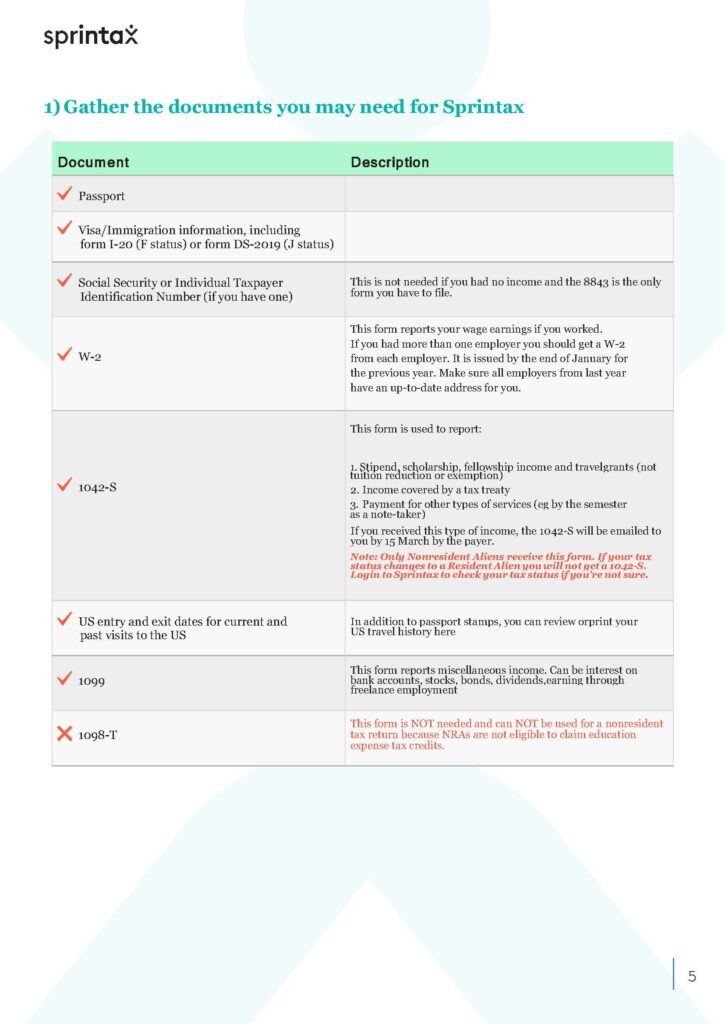

How Do I File Taxes?

How to Contact Sprintax Support

If you need help while using Sprintax, you can contact their support team using the options below:

- Email hello@sprintax.com

- 24/7 Live Chat Help (available after you create your Sprintax account)

- Refer to the Sprintax FAQs

What is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service. The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have and are not eligible to obtain a Social Security number (SSN) from the Social Security Administration (SSA).

If you expect to receive a taxable scholarship, fellowship or grant income and you do not have or qualify for a Social Security Number (SSN), you must apply for an ITIN.

If you need an ITIN, Sprintax will guide you through the process of applying for one. If you have received income in the U.S. without an ITIN or SSN, Sprintax can help you to obtain an ITIN and to file a federal tax return.

What is a 1098 Form?

- Form 1098-T is a document issued by Elmhurst University summarizing student-related educational costs for annual income tax returns. The form summarizes qualified tuition and fees for the calendar year (January 1-December 31).

- Students file Form 1098-T to claim tax education credit. Generally, international students cannot claim the tax education credit, though some students are eligible if they are deemed to be Resident Aliens for tax purposes under the IRS substantial presence test.

- In order to obtain a Form 1098-T, a student must have a social security number (SSN). Students who do not have an SSN may apply for an individual tax identification number (ITIN) from the IRS.

- Eligible students will be notified when the form 1098-T is available and can obtain it from their myElmhurst Portal account.

Working in the U.S. and Taxes

Social Security/Medicare Taxes

- “U.S. Tax Guide for Aliens” (IRS Publication 519) indicates that Social Security or Medicare taxes are not to be withheld from earnings for services performed to carry out the purpose for which an F-1 student was admitted to the United States. The types of services exempt from Social Security and Medicare withholding include on-campus work, practical training, and economic hardship employment (IRS Publication 519, p. 39, Students and Exchange Visitors).

- F-1 international students are exempt from these withholdings as long as they are considered to be a “non-resident alien” for tax purposes. Students maintaining legal F-1 status are generally considered to be a non-resident alien if they have been in the United States for a period of fewer than five years.

- To avoid paying these taxes make sure all your student employment hiring paperwork is completed correctly.

How to Avoid Tax Scams

A message from the USCIS Public Engagement Division:

Do not fall victim to scammers who call and say they are with the Internal Revenue Service (IRS)! There has been an increase in aggressive phone scams where people call and threaten you with police arrest or deportation if you don’t pay them.

Even if you do owe taxes…

- The IRS will NEVER call and demand immediate payment over the phone.

- The IRS will NEVER try to threaten or intimidate you, demand payment with a prepaid debit card, or ask for your credit card or debit card number over the phone.

- The IRS will NEVER threaten to call the police or immigration agents if you don’t pay.

If you get a call like this, report it to the Treasury Inspector General for Tax Administration by calling (800) 366-4484 or visiting www.tigta.gov. Also, report it to the Federal Trade Commission at www.ftc.gov/complaint.

For more information on tax scams, watch this video and read this IRS Tax Tip. If you think you owe taxes, you can call the IRS at (800) 829-1040 and they can help you arrange a payment plan.

Visit uscis.gov/avoidscams or uscis.gov/eviteestafas to learn how to recognize and avoid immigration scams and find authorized legal services.

Year-End Reminders

The following is highly recommended:

- Students should sign up to receive their W-2 PDF electronically on Self Service (Search for Courses). This is important because mailing addresses on record may be international, and students need to obtain their W-2 locally.

- View instructions on opting in to receive your W-2 PDF electronically.

- Students should connect their University Sprintax account to their individual Sprintax tax account so that they can import the data directly. This will make the tax filing process much easier.

Disclaimers

International Student Services and Global Engagement staff are not licensed tax professionals. ISS is not permitted to assist students with any IRS tax form or tax-related questions. The information on this page is provided as general advice as a service to our students. Any questions or concerns should be directed to Sprintax, a certified tax preparation professional, or a local IRS field office.